The Market Context

Retail trading technology has entered a structural transition driven by infrastructure convergence between institutional and consumer-grade systems. What once separated professional terminals from consumer platforms is increasingly a matter of interface rather than capability. This shift has elevated platform architecture from a convenience feature into a primary risk variable.

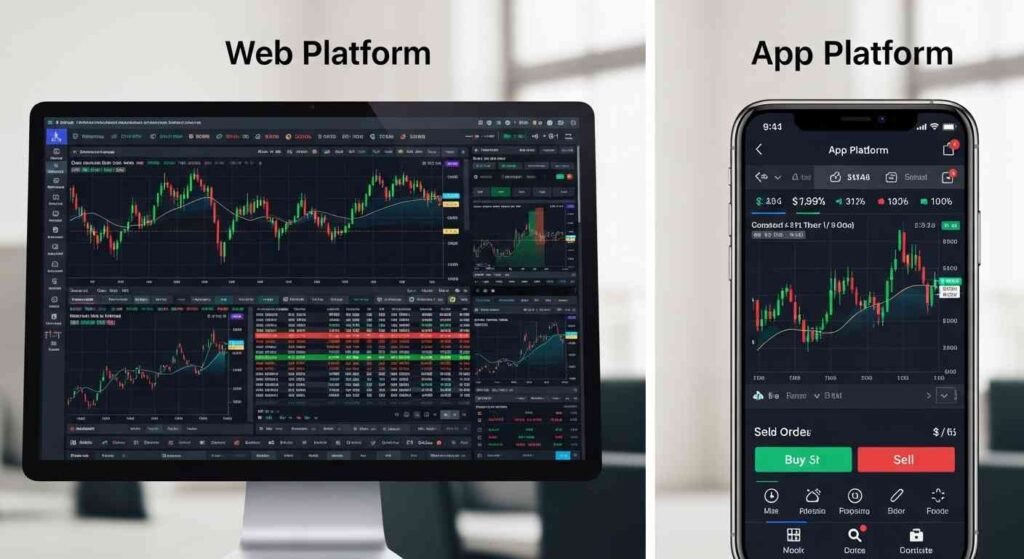

Web-based environments historically emphasized stability and cross-device compatibility, while mobile applications focused on accessibility and speed. Today, both channels compete on execution integrity, data routing efficiency, and security design. Forensic evaluation therefore centers on internal mechanics rather than surface-level usability.

From an audit perspective, platform selection represents a capital preservation decision before it becomes a performance decision. Traders are effectively choosing an execution environment that will mediate every market interaction. That mediation layer must be scrutinized with the same rigor applied to custodial institutions.

Regulatory Infrastructure

Regulatory architecture defines the legal perimeter within which a trading platform operates. Licensing jurisdiction determines minimum capital requirements, audit frequency, and client fund segregation standards. These elements materially affect counterparty risk.

Web and app platforms ultimately connect to the same legal entity, but disclosure practices often differ by channel. A sophisticated evaluation verifies that regulatory credentials are consistent across both interfaces. Any discrepancy signals governance weaknesses.

Segregation of client funds remains a cornerstone control. Platforms operating under higher-tier regulators must demonstrate operational separation between operating capital and client balances. This reduces the probability that operational distress translates into client losses.

The Latency Equation

Latency refers to the time elapsed between order submission and execution confirmation. Even small delays can create measurable slippage during volatile conditions. Web and mobile interfaces may display identical prices, yet rely on different routing pathways.

Mobile applications often utilize optimized data compression and persistent socket connections. Web platforms typically depend on browser-based communication layers. The performance difference is therefore architectural rather than cosmetic.

From a forensic standpoint, consistency matters more than absolute speed. Platforms should demonstrate predictable execution behavior under load. Variability in latency creates an environment where price integrity becomes situational.

Institutional-grade execution is no longer exclusive to Wall Street; platforms like Pocket Option platform are narrowing the structural gap by investing in low-latency aggregation and standardized execution pathways.

User Experience (UX) Protocols

User experience is often misinterpreted as visual design. In forensic analysis, UX refers to how efficiently traders can interpret data and execute decisions. Poor layout design introduces operational risk.

Web platforms traditionally provide broader screen real estate for multi-chart analysis. Mobile applications compensate through gesture-based navigation and condensed toolsets. The relevant question is whether critical functions remain accessible without friction.

High-integrity platforms maintain functional parity across channels. Chart indicators, drawing tools, and order types should not materially differ. Inconsistency increases cognitive load and error probability.

Risk Management Features

Risk controls embedded at the platform level form a secondary defense layer beyond trader discipline. These controls determine how losses are bounded during extreme market conditions. Their presence is not optional in a mature environment.

Negative balance protection prevents account equity from falling below zero. This feature transfers tail-risk from the client to the broker. Its absence effectively exposes traders to debt risk.

Stop-loss execution quality is equally critical. Platforms must demonstrate that stop orders are processed at engine level rather than interface level. Engine-level processing reduces failure points.

Regulatory Tier Checklist

Tier-1 Regulated Environment

- Mandatory client fund segregation

- Regular third-party audits

- Capital adequacy requirements

- Formal dispute resolution channels

Offshore or Lightly Regulated Environment

- Limited segregation disclosures

- Irregular audit obligations

- Lower minimum capital thresholds

- Restricted client recourse

Platform Infrastructure Architecture

Infrastructure design determines how orders travel from interface to liquidity venue. Modern platforms rely on multi-layer architectures including front-end gateways, matching engines, and liquidity bridges. Weakness in any layer degrades overall integrity.

Web and app platforms should ultimately feed into the same execution engine. Divergent routing introduces reconciliation complexity. Complexity is the enemy of reliability.

Forensic evaluation emphasizes redundancy. Platforms with multiple data centers and failover mechanisms demonstrate operational maturity. Single-point dependency models present systemic risk.

Future Outlook

By 2026, AI-driven execution optimization is expected to become standard. Algorithms will dynamically route orders based on real-time liquidity depth and historical performance patterns. This will further compress the gap between retail and institutional execution.

Automation will also expand into risk controls, adjusting margin requirements and position limits in real time. Platforms unable to integrate these capabilities will face competitive erosion.

Ultimately, the distinction between web and app trading platforms will become increasingly symbolic. What will matter is whether the underlying infrastructure meets institutional-grade standards. Traders who evaluate platforms through this lens position themselves on the correct side of technological evolution.